Results Confirm Presence of High-Grade Gold Corridors Down-Dip of Past Drilling and Highlight Potential at Depth

Vancouver, BC, June – Karus Gold Corp (“Karus Gold” or the “Company”) announces additional high-grade gold drill results including 6.5 meters (“m”) of 9.55 grams per tonne (“g/t”) gold within a broader interval of 35.4 m of 2.94 g/t gold confirming the presence of new high-grade gold corridors below historical drilling at the FG Gold Project (“Project” or “FG Gold”), part of the Company’s 1,000 square kilometer (“km”) South Cariboo Gold District in British Columbia.

Highlights

- FG-21-401 confirms the continuity of Corridor 1 gold mineralization for 50 m along strike and remains open at depth:

o 35.4 m of 2.94 g/t gold at 248 m downhole, including

o 6.5 m of 9.55 g/t gold, and

o 1.6 m of 27.1 g/t gold - Confirmed orientation of vein corridors hosting high-grade gold mineralization identified in the 2020 drill program (see news release dated June 16, 2021, titled “Karus Gold identifies multiple gold vein corridors at FG Gold”);

- Demonstrates continuity of gold mineralization within vein corridors through 25 m spaced drill holes along trend;

- Opens the potential for stacked vein corridors with several zones of increased veining outside of the targeted corridors; and

- Project remains underexplored along a >20-km trend, providing many opportunities to expand the footprint of gold mineralization and for new discoveries on-strike and downdip.

Karus Gold’s CEO, Andrew Kaip, comments, “Results from the 2021 drilling program continue to expand FG Gold mineralization on-strike and at depth, strengthening our thesis that the potential at FG Gold is much larger than the historical drilling suggest. The Company continues to find high-grade gold mineralized zones well outside of historical drilling, providing greater confidence in the structural interpretation and geologic model of the FG Gold deposit. We look forward to our 2022 exploration program at FG Gold with the aim of expanding the high-grade gold vein corridors which remain open along strike and at depth.”

Exploration Program Details

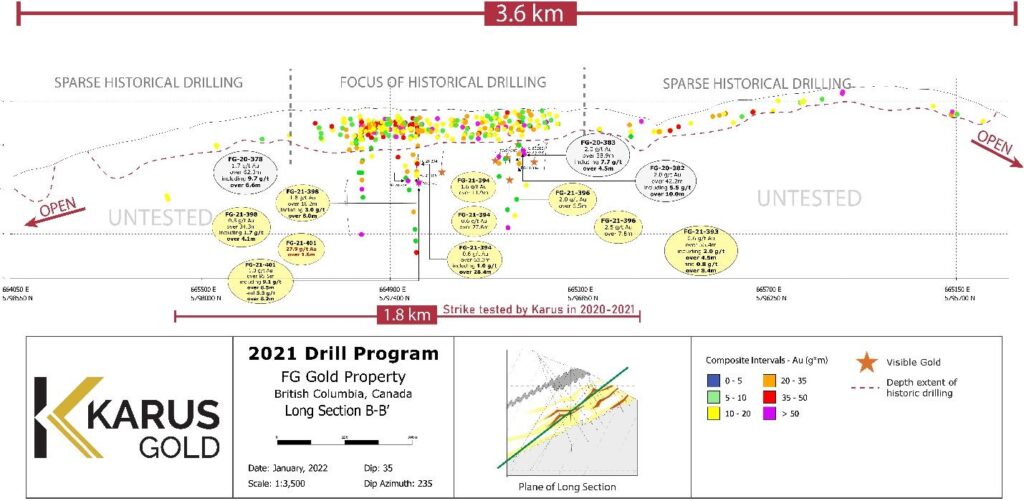

Nineteen large diameter (HQ) oriented core drill holes for a total of 7,142 m in 19 diamond drill holes were completed between July and September, 2021 (Figure 2). The drill program was designed to demonstrate continuity of gold mineralization within vein corridors through 25 and 50 m spaced drill holes along trend. The program targeted the continuation of known gold-mineralized [orogenic] quartz veins further down dip and along strike within prospective and un-tested regions of the targeted [phyllite] host rock.

Assays from holes FG-21-391, FG-21-393, FG-21-394, FG-21-396, FG-21-398 and FG-21-401 are reported in this news release. Assays for the remaining 12 holes of the 2021 drill program will be released as they are received. A plan map of the drill collars and traces is included in Figure 2, including the location of the cross sections in Figures 3 and 4.

Detailed Discussion of Results

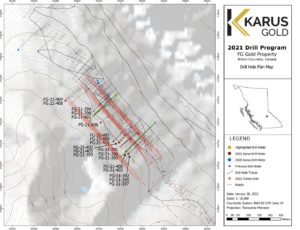

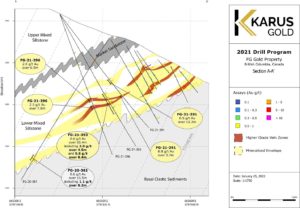

The cross-section in Figure 3 (Section line A to A’ on Figure 2) shows the location of drill holes FG-21-391, FG-21-393 and FG-21-396. The three holes drilled 25 m to the northwest and along trend of drill holes FG-20-382 and FG-20-383, which intersect broad intervals of gold mineralization coincident with increased quartz veining contained within the core of northwest trending fold hinges in Vein Corridor 1. Highlights include 2.0 g/t gold over 42.2 m beginning 122.8 m down hole, including 5.5 g/t gold over 10 m beginning 124 m down hole in FG-20-282 (see news release dated June 9, 2021, titled “Karus Gold Drills 5.3 Meters of 10.2 g/t gold and 10 Meters of 5.5 g/t Gold from Upper Zone at FG Gold”).

To better understand the dimensions of Vein Corridor 1, drill holes FG-21-391, FG-21-393 and FG-21-396 were drilled in a fan configuration to define the upper limit (FG-21-391), core (FG-21-393) and lower limit (FG-21-396) of Vein Corridor 1. The three holes achieved the objective of proving the structural orientation and demonstrating continuity of Vein Corridor 1 along trend. As the Company predicted, hole FG-21-393 drilled into the core of Vein Corridor 1, intersecting a broad interval of quartz veining that returned 0.6 g/t gold over 55.4 m beginning 218.1 m down hole. The interval of quartz veining was of comparable in length to that identified in holes FG-20-382 and FG-20-383, located 25 m to the southwest. The lower tenor of gold mineralization in FG-21-393 reflects the lower content of visible gold and highlights the variability of gold distribution within sediment hosted gold deposits such as FG Gold. Hole FG-20-391 confirmed the upper limit of Vein Corridor 1 where vein corridors pinch down between hinge zones reflecting the variability of gold mineralization down dip and along trend. FG-21-396, intersected two intervals of increased quartz veining that return 1.95 g/t gold over 6 m beginning at 216 m and 2.53 g/t gold over 9.5 m beginning at 232 m down hole indicating that Vein Corridor 1 has the potential to grow in size at depth.

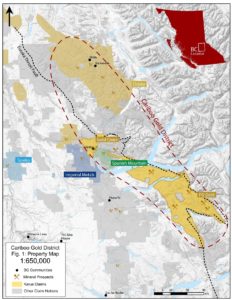

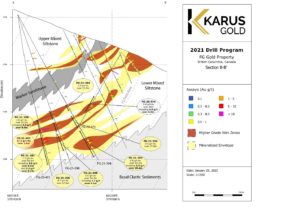

The cross-section in Figure 4 (Section line B to B’ on Figure 2) shows the location of drill holes FG-21-394, FG-21-398 and FG-21-401 which were drilled 50 m southwest and along trend of FG-20-378 which intersects 1.7 g/t gold over 62.3 m, including 9.7 g/t gold over 6.6 m (see news release dated April 22, 2021, titled “Karus Gold Drills 12.4 Meters of 4.3 3

g/t Gold at FG Gold Confirming Continuity of the Lower Zone Discovery with Widely Spaced Holes”). Hole FG-21-394, drilled to intersect the upper limit of Vein Corridor 1 intersected a series of stacked quartz veining above the interpreted trace of Vein Corridor 1, which returned 1.55 g/t gold over 8.4 m beginning 126.9 m down hole and 1.55 g/t gold over 11.9m beginning 227.5 m down hole. FG-21-394 intersected the upper limit of Vein Corridor 1 returning 0.57 g/t gold over 27.6 m beginning 242 m down hole and positively intersected a new vein corridor at depth which returned 0.58 g/t gold over 63.3 m beginning 277.5 m down hole. Hole FG-21-398 targeted the core of Vein Corridor 1, intersected three stacked zones of veining identified up dip in FG-21-394. Hole FG-21-401 drilled to define the lower limit of Vein Corridor 1 intersected the strongest intensity of quartz veining and gold mineralization and returned one of the highest intervals of gold mineralization encountered at FG Gold of 2.94 g/t gold over 35.4 m beginning 248 m downhole, including 9.55 g/t gold over 6.5 m. FG-21-401 highlights the potential to extend Vein Corridor 1 down dip and suggests gold grades could be increasing with depth.

|

Table of Significant Drill Results Drill Hole |

Zone |

From |

To |

Length1,2 |

Gold Grade3 |

|

(m) |

(m) |

(m) |

(g/t) |

||

|

FG-21-391 |

245.5 |

249.14 |

3.64 |

0.77 |

|

|

FG-21-393 |

Corridor 1 |

218.1 |

273.5 |

55.4 |

0.63 |

|

incl. |

4.5 |

2.00 |

|||

|

FG-21-394 |

New |

126.9 |

135.3 |

8.4 |

1.55 |

|

and |

New |

217.5 |

229.4 |

11.9 |

1.55 |

|

and |

Corridor 1 |

242 |

269.6 |

27.6 |

0.57 |

|

and |

New |

277.5 |

340.8 |

63.3 |

0.58 |

|

FG-21-396 |

128.45 |

134 |

5.55 |

0.83 |

|

|

and |

Corridor 1 |

216 |

222.5 |

6.5 |

1.95 |

|

and |

Corridor 1 |

232 |

241.5 |

9.5 |

2.53 |

|

FG-21-398 |

New |

216 |

232.2 |

16.2 |

1.8 |

|

and |

Corridor 1 |

241 |

258.8 |

17.8 |

0.69 |

|

and |

Corridor 1 |

267.1 |

301.4 |

34.3 |

0.51 |

|

FG-21-4014 |

Corridor 1 |

248 |

283.4 |

35.4 |

2.94 |

|

incl. |

248 |

254.5 |

6.5 |

9.55 |

|

|

incl. |

249.3 |

250.9 |

1.6 |

27.1 |

1. Karus Gold has not been able to determine true width yet due to complexity of the vein structures within the mineralized zones. The 2020 drill program was designed to better understand the geometry and how the mineralized zones are related. The orientation of individual quartz veins within the mineralized zones are quite variable. Reported widths are drill indicated core length and not true width, for the reasons above. Average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts. 2. Drilling data on the Lower Zone is currently limited and the true thickness and orientation of the zone is not firmly known. However, based on current data, it is estimated that intercept represents ~50%-75% of the true thickness of the zone. 3. Composites are calculated using a 0.3 g/t Au cutoff, incorporating no more than 7 m downhole dilution. Higher grade composite sections are calculated using a 1 g/t and 3g/t cutoff incorporating no more than 5 m downhole dilution. Screen metallic assay data is utilized preferentially over standard fire assay analysis where available as it is more representative of the true sample value due to the increased sample 4

volume processed and the multiple gold size fractions analyzed. 4. The interval reported for FG-21-401 includes one over limit assay that is yet to be received as of the date of the press release. A gravimetric gold analysis was automatically triggered for a Fire Assay analysis above 10 g/t gold. The reported interval uses 10 g/t gold for the assay interval, which will be updated once received.

Next steps

Assays from the 2021 FG drill program and district area program are being processed and we expect to begin reporting assays through H1 2021. Based on these results, Karus Gold will begin preparing for a 2022 exploration program that will be directed toward expanding the high-grade gold vein corridors at FG Gold which remain open along strike and at depth.

Regional Geology

The FG Gold property straddles the boundary between the Omineca and Intermontane tectonic belts of the Canadian Cordillera. The eastward emplacement of the Intermontane Belt onto the Omineca Belt along the Eureka Thrust Fault caused widespread regional metamorphism and structural deformation of both Belts. The regional scale, northwest trending, shallowly plunging, Eureka Syncline is one of the dominant resulting structures in the project area. Rocks in the core of the Eureka Syncline are comprised of basalt, augite porphyry flows, tuffs and volcanic breccias at dominantly lower greenschist metamorphic grade; they are structurally emplaced onto metavolcanic and sedimentary rocks of the Quesnel Terrane. The Quesnel Terrane is recognized for its prevalence of copper, gold and molybdenum mines and showings such as those at Highland Valley, Boss Mountain, QR and Mount Polley.

Property Geology

The FG Gold Project consists of 35 claims, totaling 13,008 hectares, in the eastern Cariboo region of central British Columbia is located ~100 km east of Williams Lake, British Columbia. Rocks that host FG Gold are predominantly black (“knotted”) phyllites of the Middle Triassic Slocan Group (Quesnel Terrane). These rocks, together with the Upper Triassic Nicola Group, form the northeast limb of the northwest-trending Eureka Syncline, which is situated southwest of the Eureka thrust fault; this fault represents the suture between sedimentary and volcanic rocks of the Middle-Upper Triassic Quesnel Terrane and Devonian and older rocks of ancestral North America. Gold mineralization at FG Gold is contained in a quartz-carbonate-gold vein system and considered to be a sediment-hosted orogenic gold deposit. Typical of these types of deposits, mineralization occurs as native gold within highly deformed quartz-Fe carbonate veins that contain locally abundant pyrite and pyrrhotite. Gold bearing veins are heavily modified by a minimum of two phases of post-emplacement deformation which imposes a strong control on the orientation of the gold bearing vein corridors. 5

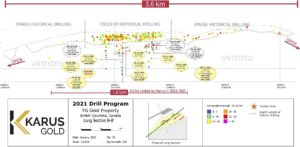

FG Gold is part of Karus Gold’s 1,000 km2 South Cariboo Gold District which hosts 110 km of the Eureka thrust structural trend (“Trend”) that drives gold mineralization in the District. The Trend is highly prospective for orogenic gold deposits, some of largest in the world, and includes the Company’s Gold Creek Project. The Cariboo region is accessible with local power, well developed road network and skilled local labour from multiple current and past operating mines.

More information is available with respect to the FG Gold Project on the NI 43-101 technical report dated November 26, 2021 “Technical Report on the South Cariboo Gold Property” filed under Karus Gold’s Profile on SEDAR at www.sedar.com and on Karus Gold’s website at www.karusgold.com.

Collar Table

|

Hole |

Length |

Azimuth |

Dip |

Easting |

Northing |

Elevation |

|

FG-21-391 |

347 |

44.76 |

-53.92 |

665399 |

5797164 |

1618 |

|

FG-21-393 |

365 |

42.5 |

-62.73 |

665399 |

5797164 |

1618 |

|

FG-21-394 |

353 |

43.29 |

-62.33 |

665149 |

5797459 |

1606 |

|

FG-21-396 |

359 |

42.78 |

-71.68 |

665399 |

5797164 |

1618 |

|

FG-21-398 |

338 |

42.59 |

-72.27 |

665149 |

5797459 |

1606 |

|

FG-21-401 |

350 |

40.79 |

-82.65 |

665149 |

5797459 |

1606 |

QA/QC and Qualified Person

Once the drill core was received from the drill site, individual samples were determined, logged for geological attributes, sawn in half, labelled, and bagged for assay submittal. The remaining drill core was then stored at a secure site in Horsefly, BC. The Company inserted quality control samples at regular intervals within the sample stream which included blanks, preparation duplicates, and standard reference materials with all sample shipments intended to monitor laboratory performance. Sample shipment was conducted under a chain of custody procedure.

Drill core samples were submitted to Bureau Veritas’ analytical facility in Vancouver, BC for preparation and analysis. Sample preparation included drying and weighing the samples, crushing the entire sample, and pulverizing 250 grams. Analysis for gold was by method FA450: 50g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.005 ppm and upper limit of 10 ppm. Gold assays greater than 10ppm are automatically analysed by method FA550: 50g fire assay fusion with a gravimetric fusion.

Bureau Veritas is accredited to the ISO/IEC 17025 standard for gold assays, and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. Parameters for Bureau Veritas’ internal and Karus Gold’s external blind quality control samples were acceptable for the analyses returned. 6

Technical information with respect to FG Gold contained in this news release has been reviewed and approved by Andrew Kaip, P.Geo., who is Karus Gold’s CEO and is a qualified person under National Instrument 43-101 responsible for the technical matters of this news release.

Listing Update

As previously disclosed in the September 23, 2021 news release, Karus Gold filed an updated listing application in October 2021 and continues to work with the TSXV to complete the listing process. About Karus Gold Corp.

Karus Gold is 100% owner of the 1,000 km2 South Caribou Gold District that includes the drill-stage FG Gold and Gold Creek projects in British Columbia. Karus Gold is supported by strategic investors Eric Sprott; and insiders, together with the management and Board, own approximately 59% of the basic shares outstanding.

Further information on Karus Gold and its assets can be found on the Company’s website at www.karusgold.com and at www.sedar.com, or by contacting us as info@karusgold.com or by telephone at (888) 455-7620.On behalf of Karus Gold

”Andrew Kaip”

Chief Executive Officer

(647) 515-7858

Investor Relations

Kin Communications

(604) 684-6730

KAR@kincommunications.com

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects”, “suggests” and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward-looking statements. Such forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future 7

results, performance or achievements expressed or implied by the forward-looking information.

Such factors include, among others: risks related to exploration and development activities at the Company’s projects, and factors relating to whether or not mineralization extraction will be commercially viable; risks related to the hazards and risks normally encountered in the exploration of minerals, such as unusual and unexpected geological formations; uncertainties regarding regulatory matters, including obtaining permits and complying with laws and regulations governing exploration, development, production, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, site safety and other matters, and the potential for existing laws and regulations to be amended or more stringently implemented by the relevant authorities; risks related to title to the Company’s properties, including the risk that the Company’s title may be challenged or impugned by third parties; the ability of the Company to access necessary resources, including mining equipment and crews, on a timely basis and at reasonable cost; competition within the mining industry for the discovery and acquisition of properties from other mining companies, many of which have greater financial, technical and other resources than the Company, for, among other things, the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel; access to suitable infrastructure, such as roads, energy and water supplies in the vicinity of the Company’s properties; and risks related to the stage of the Company’s development, including risks relating to limited financial resources, limited availability of additional financing and potential dilution to existing shareholders; reliance on its management and key personnel; inability to obtain adequate or any insurance; exposure to litigation or similar claims; currently unprofitable operations; risks regarding the ability of the Company and its management to manage growth; and potential conflicts of interest.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Figure 1. Location of the 1,000 square km South Cariboo Gold District 1,000 square km South Cariboo Gold District

Figure 2. Location of FG Gold Diamond Drill Holes and Section Lines

Figure 3. Cross Section A to A’ showing FG-20-382 and FG-20-383 (View to Northwest)

Figure 4. Cross Section B to B’ showing FG-20-385 (View to Northwest)

Figure 5. Long section highlighting pierce points of released holes