Assays Demonstrate Excellent Continuity and Strong Potential for Extending High-Grade Silver and Gold Mineralization

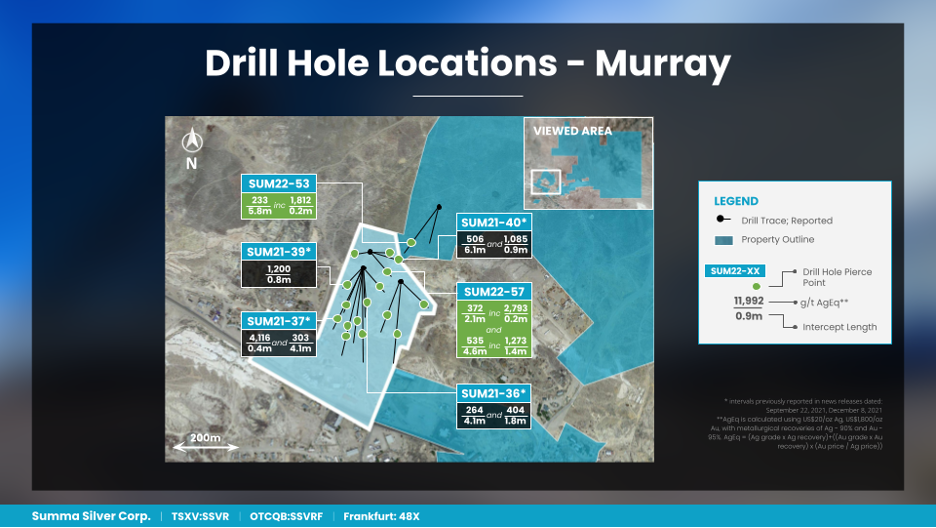

Vancouver, September 13, 2022 – Summa Silver Corp. (“Summa” or the “Company”) (TSXV:SSVR) (OTCQX: SSVRF) (Frankfurt:48X) is pleased to report continued intersections of high-grade silver and gold mineralization from the Hughes Project, near Tonopah, Nevada. Seven of the eight holes tested the Murray target on the western side of the project demonstrating excellent continuity from previous drilling results.

Murray Target:

- All holes intersected multiple zones of stacked, vein-hosted silver and gold mineralization. Highlights include (see attached figures):

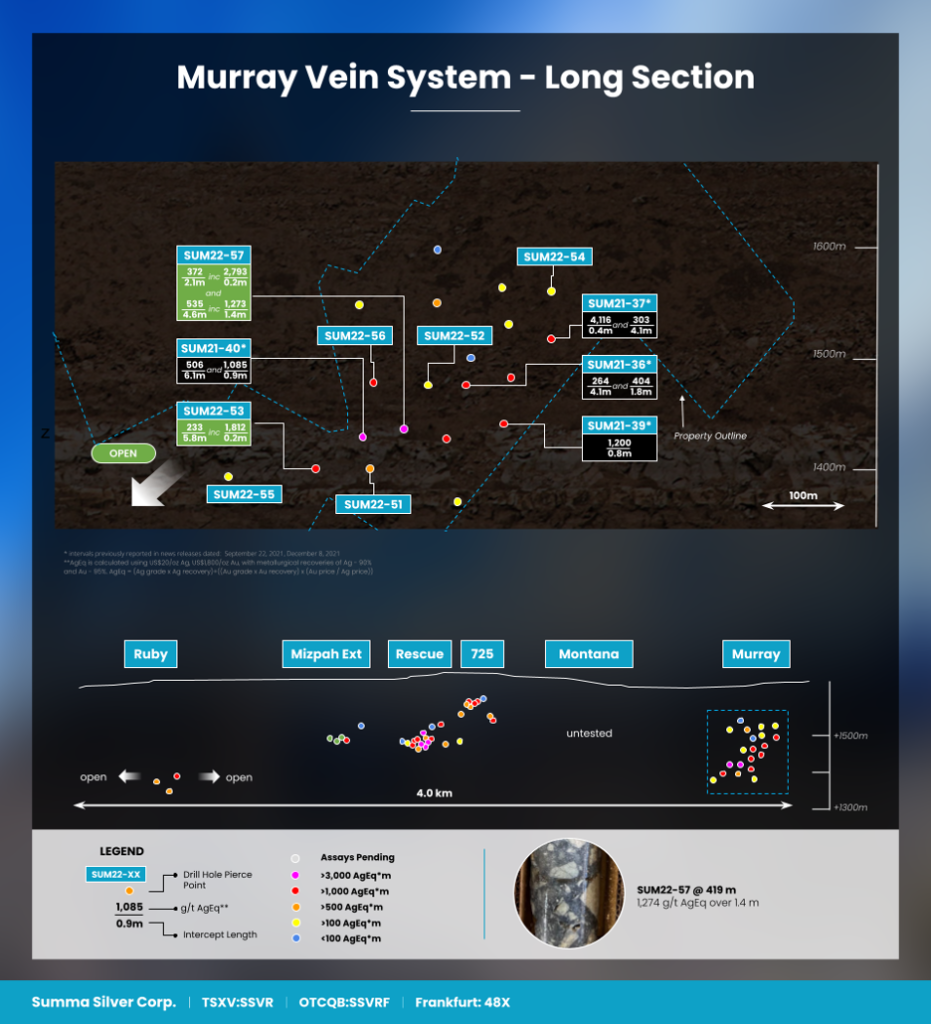

- 535 g/t silver equivalent* (335 g/t Ag and 2.73 g/t Au) over 4.6 m including 1,273 g/t silver equivalent* (811 g/t Ag and 6.35 g/t Au) over 1.4 m in SUM22-57.

- 233 g/t silver equivalent* (146 g/t Ag and 1.2 g/t Au) over 5.8 m in SUM22-53.

Belmont Target:

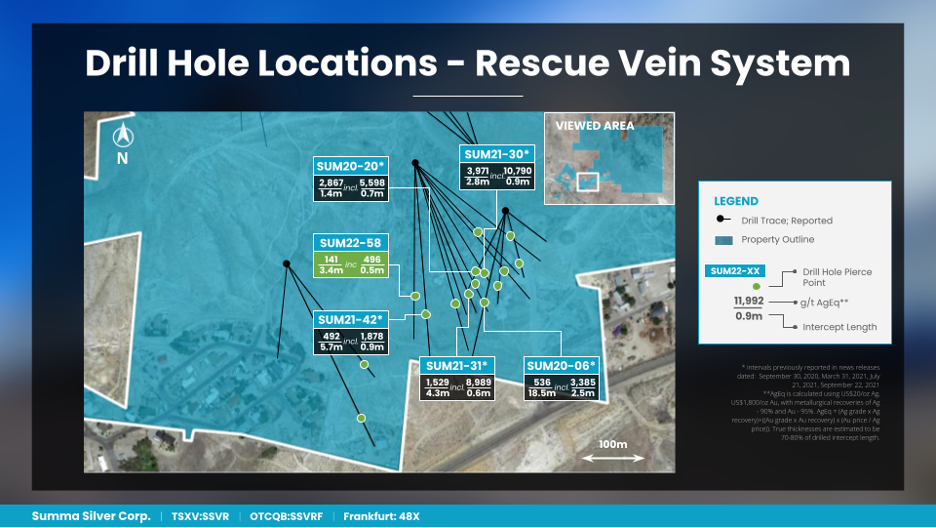

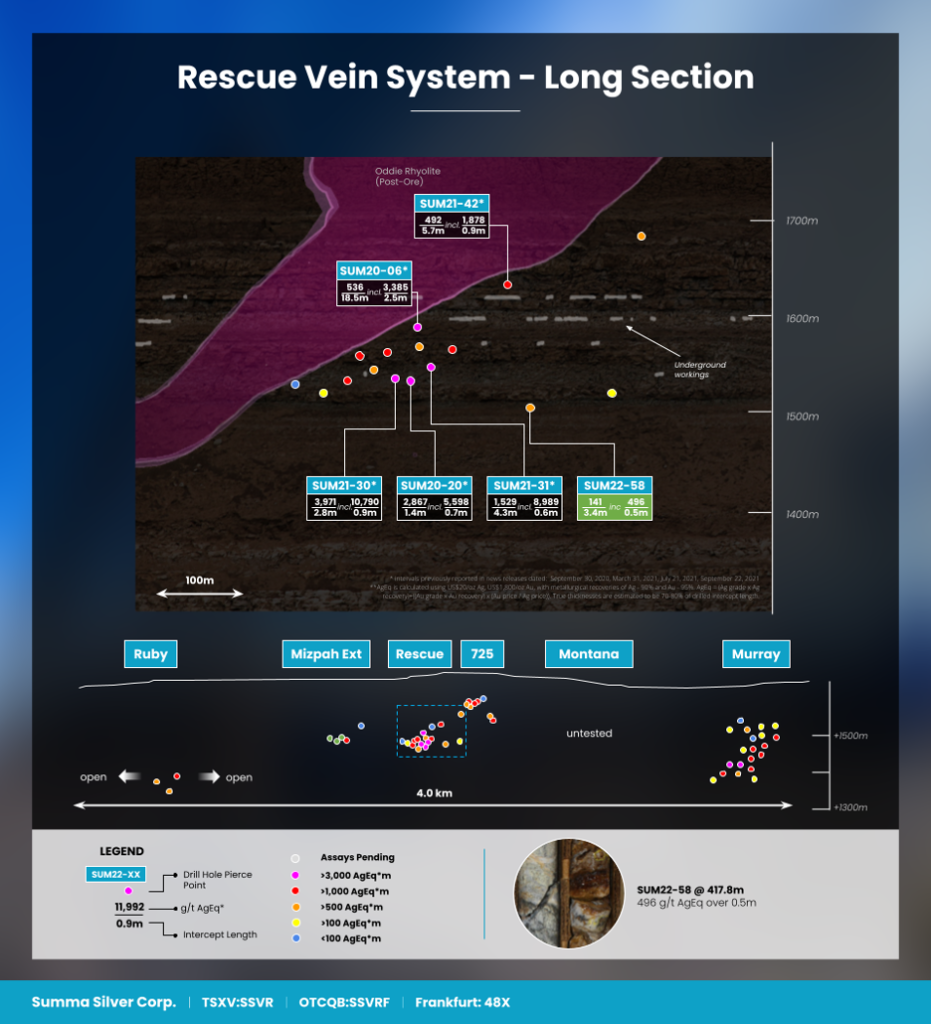

- One hole tested 100 m along-strike from the core of the stacked and high-grade Rescue Veins:

- Intersected several zones of vein-hosted silver and gold mineralization.

- 496 g/t silver equivalent* (173 g/t Ag and 4.0 g/t Au) over 0.5 m in SUM22-58.

Dimensions of Mineralization:

- High-grade mineralization at Murray has been intersected in several stacked structures over an area of 500 x 300 m where it remains open to expansion.

- High-grade mineralization at Belmont has been intersected in several stacked structures over an area of 400 x 100 m where it remains open to expansion.

- Further mineralization is present in multiple additional areas over a length of 3.5 km, including the Ruby discovery, a 1.3 km step-out from the historic Belmont Mine.

*AgEq is calculated using US$20/oz Ag, US$1,800/oz Au, with metallurgical recoveries of Ag – 90% and Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)). True widths are not yet known.

Galen McNamara, CEO, stated: “We continue to be pleased with the results from the Hughes project in the historic Tonopah district. This classic American high-grade silver district still has much to offer, and we have the feeling that between the two companies active in the district, we are only beginning to scratch the surface of the full discovery potential here.”

Table 1: Assay Results

| Drill Hole | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) | AgEq (g/t) | Vein Set |

| SUM22-0051 | 382.5 | 382.8 | 0.3 | 1.3 | 55 | 157 | Murray |

| and | 444.2 | 445.6 | 1.4 | 0.9 | 82 | 147 | |

| and | 451.7 | 452.6 | 0.9 | 1.5 | 174 | 283 | |

| and | 456.8 | 457.3 | 0.5 | 0.5 | 67 | 104 | |

| SUM22-0052 | 369.5 | 369.9 | 0.4 | 1.0 | 107 | 182 | Murray |

| and | 403.3 | 405.3 | 2.0 | 0.9 | 69 | 136 | |

| including | 404.8 | 405.3 | 0.5 | 1.5 | 211 | 317 | |

| SUM22-0053 | 406.6 | 412.4 | 5.8 | 1.2 | 146 | 233 | Murray |

| including | 411.4 | 412.4 | 1.0 | 2.3 | 261 | 433 | |

| including | 412.2 | 412.4 | 0.2 | 9.8 | 1081 | 1812 | |

| SUM22-0054 | 238.4 | 238.7 | 0.3 | 1.0 | 64 | 142 | Murray |

| and | 277.0 | 277.2 | 0.2 | 2.2 | 127 | 302 | |

| and | 280.1 | 280.4 | 0.3 | 0.9 | 80 | 152 | |

| and | 336.6 | 337.7 | 1.1 | 2.4 | 200 | 388 | |

| including | 336.9 | 337.2 | 0.3 | 3.2 | 283 | 525 | |

| SUM22-0055 | 413.9 | 414.7 | 0.8 | 0.6 | 114 | 153 | Murray |

| and | 464.5 | 464.9 | 0.4 | 1.9 | 67 | 222 | |

| SUM22-0056 | 326.3 | 326.6 | 0.3 | 0.5 | 82 | 114 | Murray |

| and | 371.9 | 372.5 | 0.6 | 0.6 | 53 | 101 | |

| and | 377.8 | 379.8 | 2.0 | 0.9 | 82 | 152 | |

| and | 383.1 | 383.7 | 0.6 | 0.8 | 92 | 154 | |

| and | 386.9 | 387.2 | 0.3 | 0.8 | 76 | 139 | |

| and | 393.8 | 394.7 | 0.9 | 1.3 | 101 | 200 | |

| and | 397.9 | 402.4 | 4.5 | 0.9 | 85 | 154 | |

| including | 399.9 | 401.2 | 1.3 | 1.4 | 118 | 222 | |

| including | 401.6 | 402.4 | 0.8 | 1.7 | 184 | 312 | |

| and | 405.1 | 406.1 | 1.0 | 2.8 | 318 | 526 | |

| and | 410.7 | 411.8 | 1.1 | 1.3 | 101 | 204 | |

| SUM22-0057 | 335.4 | 337.5 | 2.1 | 2.6 | 166 | 372 | Murray |

| including | 337.0 | 337.2 | 0.2 | 19.6 | 1245 | 2793 | |

| and | 411.5 | 412.8 | 1.3 | 1.4 | 189 | 289 | |

| and | 417.2 | 421.8 | 4.6 | 2.7 | 335 | 535 | |

| including | 419.1 | 420.5 | 1.4 | 6.3 | 811 | 1273 | |

| and | 424.0 | 425.6 | 1.6 | 0.6 | 64 | 132 | |

| and | 434.0 | 435.3 | 1.2 | 1.9 | 124 | 277 | |

| and | 442.9 | 448.2 | 5.3 | 1.0 | 74 | 149 | |

| including | 442.9 | 443.4 | 0.5 | 7.0 | 316 | 887 | |

| SUM22-0058 | 417.8 | 421.2 | 3.4 | 1.0 | 65 | 141 | Rescue |

| including | 417.8 | 418.2 | 0.5 | 4.0 | 173 | 496 | |

| and | 436.4 | 437.5 | 1.1 | 0.8 | 88 | 147 | |

| and | 451.5 | 451.8 | 0.3 | 0.6 | 61 | 103 |

*AgEq is calculated using US$20/oz Ag, US$1,800/oz Au, with metallurgical recoveries of Ag – 90% and Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price))

Drill Program

Murray Target

Results from all seven holes that tested the Murray vein-system on the western side of the Hughes project in 2022 are reported in Table 1. The infill and exploration holes were designed to further investigate grade continuity and the extension of mineralization up- and down-dip along the Murray vein-system. Previous drilling at Murray has identified significant broad zones of high-grade silver and gold mineralization (e.g., 455 g/t silver equivalent* over 6.1 m in SUM21-40; see September 22nd, 2021 news release).

Figure 1: Murray Target drill hole locations

Recent geological modelling at Murray suggests that mineralization is hosted in a series of stacked veins and oblique vein-splays rather than one complex vein. Mineralization is associated with broad intervals of strong argillic alteration cored by zones of quartz stockwork up to 30 m wide and local Ag-sulfide bearing, banded quartz veins. This stacked vein interpretation is supported by hole SUM22-57, which intersected a broad 110 m zone comprised of numerous intervals of epithermal-related mineralization and associated veins and vein-breccias (e.g., 2,793 g/t AgEq over 0.2 m and 535 g/AgEq over 4.6 m including 1,273 g/t AgEq over 1.4 m). Similarly, hole SUM22-56 intersected multiple zones of mineralization over 85 meters (Table 1).

Figure 2: Murray Target long Section

Hole SUM22-53 represents one of the largest down-dip step-out holes drilled to date at the Murray target (Figure 2). The hole intersected 233 g/t AgEq over 5.8 m and supports the down-dip potential of the Murray vein-system.

Further drilling down-dip as well as drilling focused on targeting veins and interpreted vein-splays higher-up in the Murray system is warranted. Geological modelling is ongoing and targets across the project, including Murray, are being ranked and prioritised for the next round of drilling.

Belmont Target

Results from one hole (SUM22-58) that tested the Rescue Veins of the Belmont Target are reported in Table 1. The hole was designed to test for the along-strike and down-dip extent of the high-grade core to the complex, multi-vein, stacked system (e.g., 3,971 g/t silver equivalent* over 2.8 m in SUM21-30 and 1,559 g/t silver equivalent* over 4.3 m in SUM21-31; see news releases from July 21st, 2021 and September 22nd, 2021). The hole intersected multiple zones banded to brecciated quartz ± adularia veins with local silver sulfides and associated argillic alteration halos highlighted by 496 g/t silver equivalent over 0.5 m within 141 g/t silver equivalent over 3.4 m (Table 1). The results demonstrate mineralization continuity within many of the high-grade Rescue veins along strike to the west. Further drilling and modeling are required to fully evaluate the new zone for additional higher-grade and plunging mineralized shoots.

Figure 3: Belmont Target drill hole locations

Figure 4: Rescue vein system long section

Table 2: Collar Information for SUM22-51 to SUM22-58

| Target Area | Drill Hole | Easting | Northing | Azimuth | Dip | Final Depth (m) |

| Murray | SUM22-0051 | 479333 | 4214215 | 92 | -82 | 539 |

| Murray | SUM22-0052 | 479305 | 4214150 | 142 | -77 | 464 |

| Murray | SUM22-0053 | 479598 | 4214379 | 214 | -70 | 587 |

| Murray | SUM22-0054 | 479305 | 4214150 | 195 | -45 | 442 |

| Murray | SUM22-0055 | 479598 | 4214379 | 230 | -76 | 671 |

| Murray | SUM22-0056 | 479430 | 4214109 | 153 | -88 | 475 |

| Murray | SUM22-0057 | 479333 | 4214215 | 150 | -77 | 528 |

| Belmont | SUM22-0058 | 481056 | 4213620 | 188 | -63 | 553 |

UTM Z 11 NAD27

Analytical and QA/QC Procedures

All samples were sent to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with ISO/IEC Standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish (“Au-AA30”) and silver via atomic emission spectroscopy or inductively coupled plasma mass spectroscopy after four-acid digestion (“AgMA-AAS or 48MA-MS”). Samples that assayed over 8 ppm Au were re-run via fire assay with a gravimetric finish (“Au-GR30”). Samples that assayed over 200 or 100 ppm Ag (depending on Ag method) were re-run via fire assay for Ag with a gravimetric finish (“Ag-GRAA30”). In addition to Paragon quality assurance / quality control (“QA/QC”) protocols, Summa Silver implements an internal QA/QC program that includes the insertion of sample blanks, duplicates and certified reference materials at systematic and random points in the sample stream.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company owns a 100% interest in the Hughes property located in central Nevada and has an option to earn 100% interest in the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The Mogollon property is the largest historic silver producer in New Mexico. Both properties have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

Investor Relations Contact:

(604)288-8004

This news release contains certain statements that may constitute forward-looking information under applicable securities laws. All statements, other than those of historical fact, which address activities, events, outcomes, results, developments, performance or achievements that Summa anticipates or expects may or will occur in the future (in whole or in part) should be considered forward-looking information. Such information may involve, but is not limited to, statements with respect to: exploration and development of the Company’s mineral exploration properties, including but not limited to expansion potential at the Hughes Project; and discovery potential at the Tonopah District. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or statements formed in the future tense or indicating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or other variations of the forgoing) be taken, occur, be achieved, or come to pass. Forward-looking information is based on currently available competitive, financial and economic data and operating plans, strategies or beliefs as of the date of this news release, but involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of Summa to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors may be based on information currently available to Summa, including information obtained from third-party industry analysts and other third-party sources, and are based on management’s current expectations or beliefs regarding future growth, results of operations, future capital (including the amount, nature and sources of funding thereof) and expenditures. Any and all forward-looking information contained in this press release is expressly qualified by this cautionary statement. Trading in the securities of Summa should be considered highly speculative.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.