Assays Pending from Multiple Holes Encountering Visible Silver Sulfide Mineralization, ~$9M in Working Capital to Deploy

Vancouver, July 20, 2022 – Summa Silver Corp. (“Summa” or the “Company”) (TSXV:SSVR) (OTCQX:SSVRF) (Frankfurt:48X) is pleased to provide an update on its exploration activities across the high-grade Hughes Project, near Tonopah, Nevada (the “Hughes Project”).

Key Highlights:

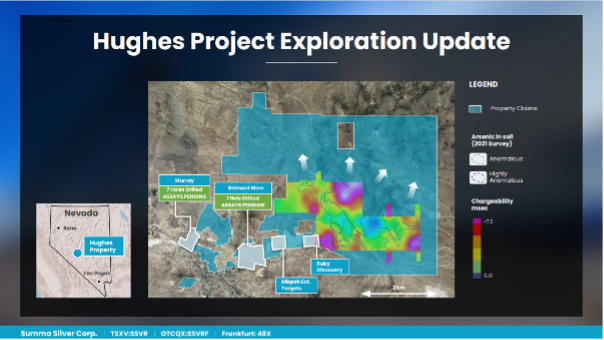

- Assays Pending from Multiple Holes: The Company has drilled eight holes at the Hughes Project concentrating on resource style spacing at the Murray and Belmont target areas (see attached figure).

- Mineralization Encountered: All holes have intersected zones of quartz veins, stockworks and breccias featuring visible silver sulfide mineralization.

- Underexplored Project: Geological mapping and soil sampling across recently acquired claims is underway and has already identified multiple new high-potential targets. The focus is on target generation within sight of the historic Tonopah mining district.

- Well Capitalized: The Company is well capitalized for extensive drilling with approximately $9 million in working capital to deploy.

- Transitioning to Mogollon Project: Drilling is now complete at Hughes and preparations are being made to return to drilling at the Mogollon Project where hole MOG22-05 recently intersected 31m at 448 g/t silver equivalent* (3.88 g/t Au, 129 g/t Ag). (See press release dated May 3, 2022).

*AgEq is calculated using US$20/oz Ag, US$1,800/oz Au, with metallurgical recoveries of Ag – 90% and Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price))

Dimensions of Mineralization:

- High-grade mineralization at Rescue has been intersected in several stacked structures over an area of 400 x 100 m where it remains open to expansion.

- High-grade mineralization at Murray has been intersected over an area of 500 x 300 m where it remains open to expansion.

- Further mineralization is present in multiple additional areas over a length of 3.5 km, including the Ruby discovery, a 1.3 km step-out from the historic Belmont Mine.

Galen McNamara, CEO, stated: “All holes drilled at Hughes so far have hit their target and our technical team is rapidly advancing the exploration model for the entire project package. We control a dominant land package in this premier historic American high-grade silver district which remarkably remains substantially underexplored. On the Hughes Project, high grade mineralization has been intersected in four target areas over 3.5 km. These zones remain open to expansion, and we are only just beginning to wrap our arms around what’s remaining here”.

Drill Program and Models

Seven holes have been drilled at the Murray target and one hole has been drilled at the Belmont target. The Murray holes were designed to further investigate grade continuity within the vein-system where previous drilling has defined significant zones of vein-hosted high-grade silver and gold mineralization (e.g., 455 g/t silver equivalent* over 6.1 m in SUM21-40; see September 22nd, 2021 news release). The drilled footprint at Murray covers a down-dip extent of over 500 m along the vein-system. Assay results from these holes are pending.

The drill rig is currently drilling at the Belmont target investigating the extent of the high-grade core to the complex, multi-vein, stacked system (e.g., 3,971 g/t silver equivalent* over 2.8 m in SUM21-30 and 1,559 g/t silver equivalent* over 4.3 m in SUM21-31; see July 21st, 2021 and September 22nd, 2021 news releases).

The new drill data will be incorporated into an updated geological and structural model for the entire district. A significant effort has recently gone into further digitizing historic underground maps from the early 1900’s. These maps have informed the vein and structural model and have led to identification of previously unknown veins and structural offsets. New targets peripheral to areas previously drilled by Summa have been generated and will be investigated in future drill programs.

*AgEq is calculated using US$20/oz Ag, US$1,800/oz Au, with metallurgical recoveries of Ag – 90% and Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price))

Target Generation

Geological mapping, prospecting and soil geochemical sampling across recently acquired claims (see July 7th, 2021 and March 28th, 2022 news releases) is ongoing. The focus for the geological mapping and prospecting is to refine the lithological and structural model for the district to better define the limits of prospective rock units and associated structural offsets and the breadth outcropping alteration zones.

The soil surveys will focus on silver and gold as well as pathfinder elements known to be associated with Tonopah-style epithermal-related, high-grade silver and gold mineralization hosted in older Mizpah Formation volcanic rocks as well as younger, gold-dominant systems hosted in overlying Siebert Formation and Fraction Volcanics. Samples are being analyzed with a portable Xray fluorescence spectrometer (pXRF) to measure elemental concentrations from prepared sample mounts in the field. Select samples will also be sent to the lab for full multi-element, low-detection geochemical analyses.

Numerous open-ended multi-element soil-geochemical anomalies were previously defined (see August 16th, 2021 news release) to the northeast of the Belmont Mine. These anomalies are locally associated with strong geophysical anomalies (e.g., chargeability and resistivity, see June 22nd, 2021 news release). Follow-up sample grids are being completed northeast of these areas to define the spatial extent of these anomalies as well as over new areas north of the Belmont Mine. Following the completion of the surveys, sample coverage will be property-wide.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company owns a 100% interest in the Hughes property located in central Nevada and has an option to earn 100% interest in the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The Mogollon property is the largest historic silver producer in New Mexico. Both properties have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

info@summasilver.com

www.summasilver.com

Investor Relations Contact:

Kin Communications

Giordy Belfiore

604-684-6730

giordy@summasilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the release of assays; the exploration and development of the Company’s mineral exploration projects including completion of surveys and drilling activities.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; the ongoing conflict in Ukraine; and other related risks and uncertainties disclosed in the Company’s public disclosure documents.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.