total client

market cap

EXCHANGES

NASDAQ ∙ TSX ∙ TSX-V ∙ CSE ∙ OTC

TOTAL CAPITAL

RAISED

The Kin Difference

Small Cap Problems.

Kin Communications Solutions.

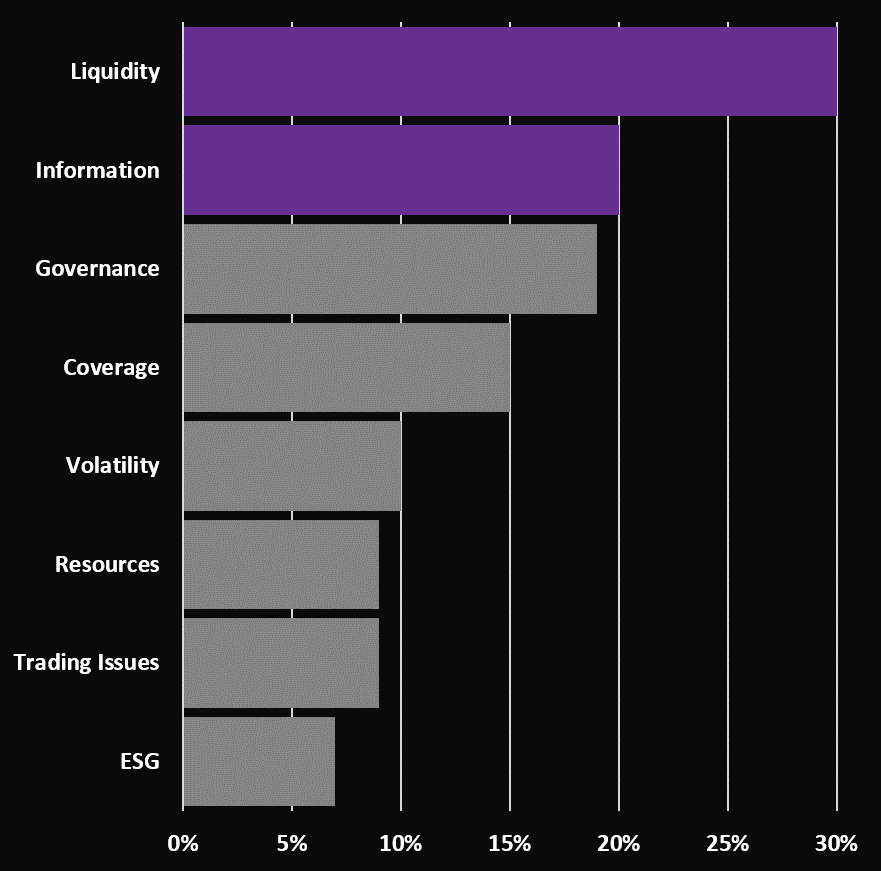

IR Magazine’s Q4 2019 survey asked both the buy-side and sell-side what the largest challenges are for small cap (<$1B Mkt Cap) companies. The two most common comments were:

Liquidity

Investors are concerned about having money tied up in small-cap companies, whether they can get enough investment in the first place and whether they can readily get out of that position when needed.

Information

Investors often feel there is not enough data on small-cap companies for them to make an informed investment decision. They are also concerned about the lack of transparency at small caps and whether these companies are able to regularly provide investors with the information they need.

The Kin Difference.

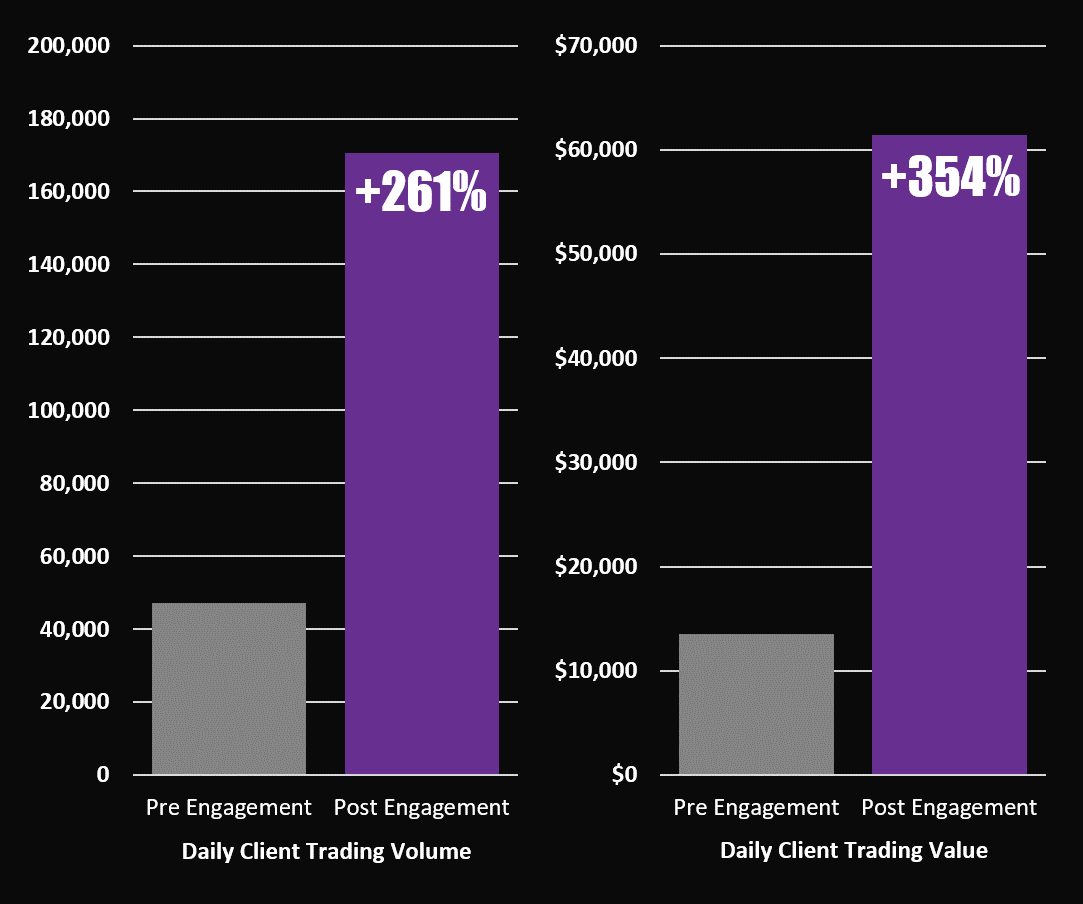

Measurable Results.

Our online and offline activities have built a track record of success with clients across a broad range of sectors. These activities allow clients to build an active shareholder base, to establish liquidity through effective delivery and execution of communication, and to successfully differentiate our clients from their peers.

Case Studies

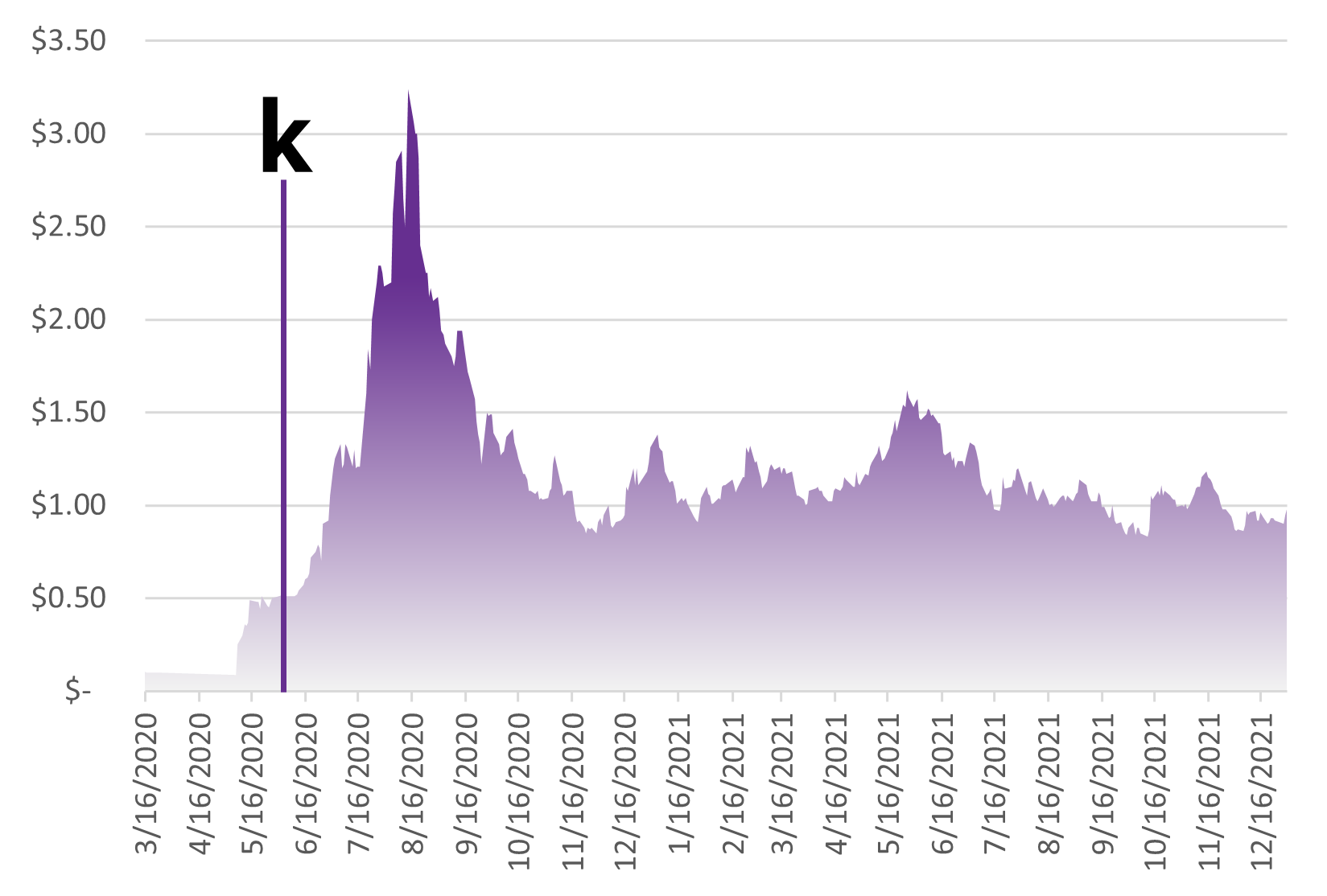

Summa Silver TSX-V:SSVR | OTCQB:SSVRF

Initiation Date

| 90 Day Average Before | |

|---|---|

| volume: | 35,557 |

| volume ($): | 14,162 |

| 90 Day Average After | |

|---|---|

| Volume: | 125,182 +252% |

| Volume ($): | 195,028 +1,277% |

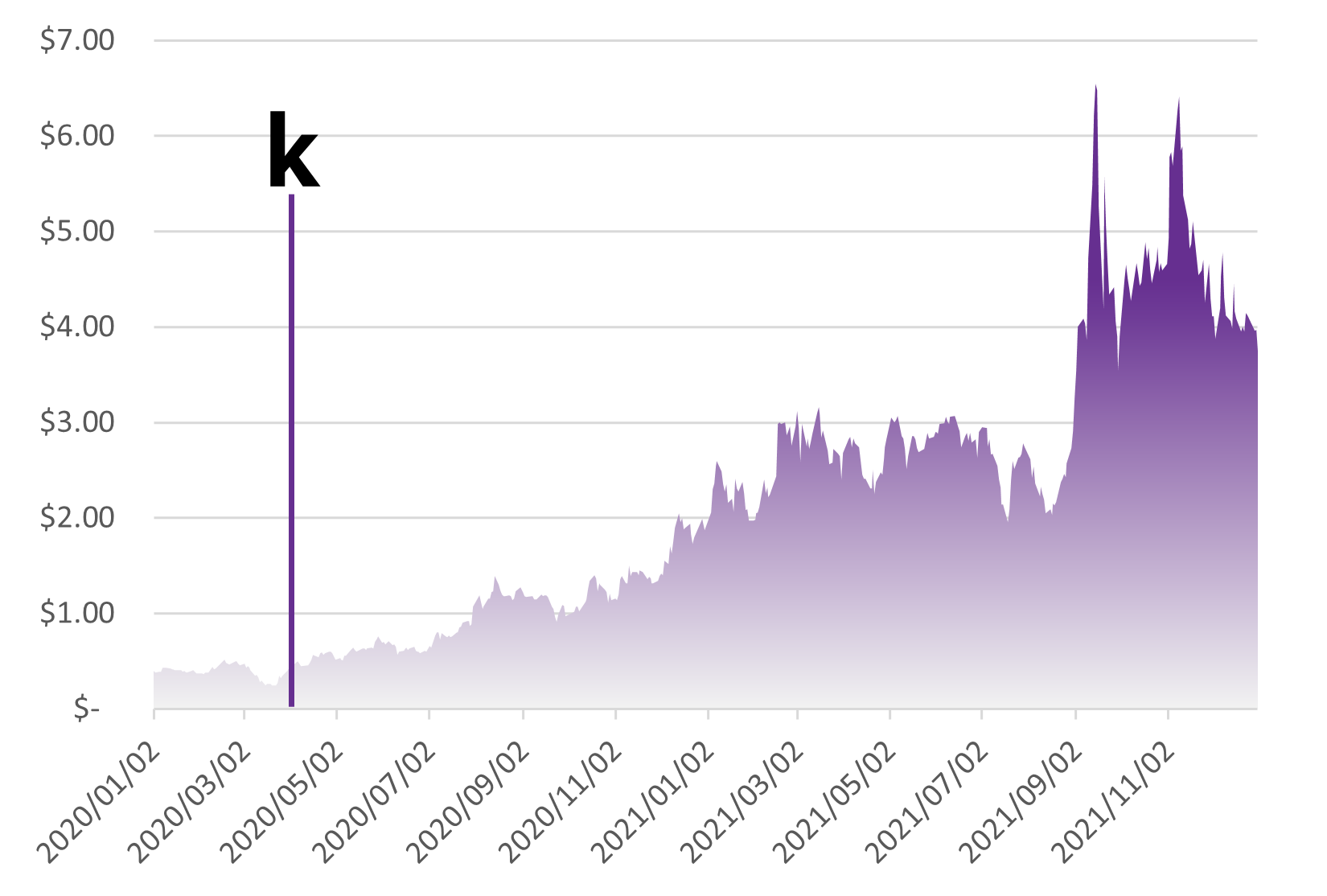

IsoEnergy TSX-V:ISO | OTC:ISENF

Initiation Date

| 90 Day Average Before | |

|---|---|

| volume: | 139,936 |

| volume ($): | 57,596 |

| Trades: | 26 |

| 90 Day Average After | |

|---|---|

| Volume: | 215,510 +54% |

| Volume ($): | 124,226 +191% |

| Trades: | 45 +74% |